Extended Auto Insurance: Comprehensive Coverage for Your Vehicle

When it comes to protecting your vehicle and your peace of mind on the road, Extended Auto Insurance plays a crucial role. This article delves into the importance of extended auto insurance, what it covers, and how it can benefit you as a vehicle owner.

Understanding Extended Auto Insurance

Extended Auto Insurance, often known as extended car warranty or vehicle service contract, is a specialized insurance policy designed to cover unexpected repair costs beyond your manufacturer's warranty. It offers an additional layer of protection for your vehicle, ensuring that you're not left with hefty repair bills.

Key Benefits of Extended Auto Insurance:

Here are some compelling reasons why opting for Extended Auto Insurance is a wise decision:

- Comprehensive Coverage: Extended auto insurance provides comprehensive coverage for various vehicle components, including the engine, transmission, electrical systems, and more. It offers peace of mind knowing that major repairs are taken care of.

- Financial Security: Unexpected repairs can strain your finances. With extended auto insurance, you won't have to worry about these expenses, as the policy covers repair and replacement costs, reducing your financial burden.

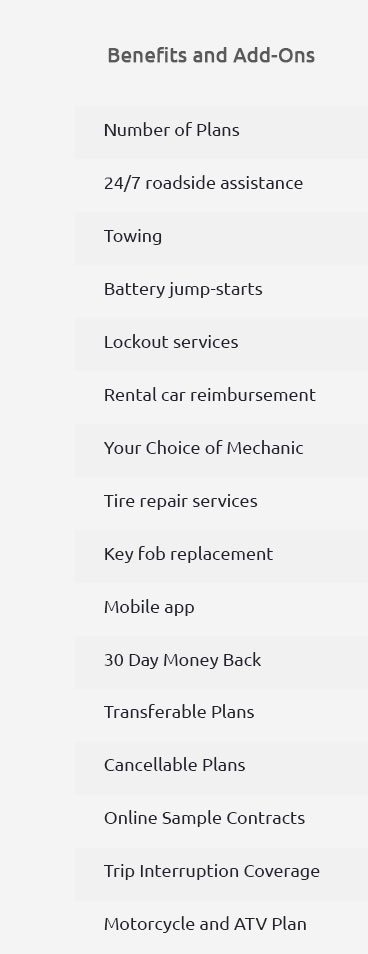

- Customizable Plans: Many extended auto insurance providers offer customizable plans, allowing you to tailor coverage to your specific needs. Whether you want basic coverage or a comprehensive plan, there's an option for you.

- Transferable: Extended auto insurance is often transferable to the new owner if you decide to sell your vehicle. This can enhance the resale value of your car.

What Extended Auto Insurance Covers:

Extended auto insurance typically covers a range of components and systems in your vehicle, including but not limited to:

- Engine

- Transmission

- Drive Axle

- Steering

- Electrical Systems

- Air Conditioning

- Brakes

- And more...

Choosing the Right Extended Auto Insurance:

Here are some tips for selecting the right extended auto insurance plan:

- Research Providers: Take your time to research and compare extended auto insurance providers. Look for reputable companies with a history of excellent service and claims processing.

- Assess Coverage: Carefully review what each plan covers and any exclusions or limitations. Ensure that the coverage aligns with your vehicle's needs.

- Consider Budget: Evaluate the cost of the extended auto insurance plan and consider it in the context of potential repair expenses without coverage. Choose a plan that fits your budget.

- Read Reviews: Read customer reviews and testimonials to gauge the experiences of other policyholders. This can provide valuable insights into the provider's reliability.

Conclusion:

Extended Auto Insurance is a valuable investment for vehicle owners who want peace of mind and financial security. With comprehensive coverage, customizable plans, and the assurance that unexpected repairs are taken care of, extended auto insurance offers a safety net on the road. Make an informed choice when selecting the right extended auto insurance plan to protect your valuable asset.

|